What Is The Max Fica Tax For 2025

What Is The Max Fica Tax For 2025 - What Is And How To Calculate FICA Taxes Explained, Social Security, The social security administration (ssa) announced that the. In 2023, only the first $160,200 of your earnings are subject to the social security tax. What Is FICA Tax and Do You Have to Pay It? Tax Relief Professional, 6.2% social security tax on the first $168,600 of employee wages (maximum tax is. In 2025, this limit rises to $168,600, up from the 2023 limit of $160,200.

What Is And How To Calculate FICA Taxes Explained, Social Security, The social security administration (ssa) announced that the. In 2023, only the first $160,200 of your earnings are subject to the social security tax.

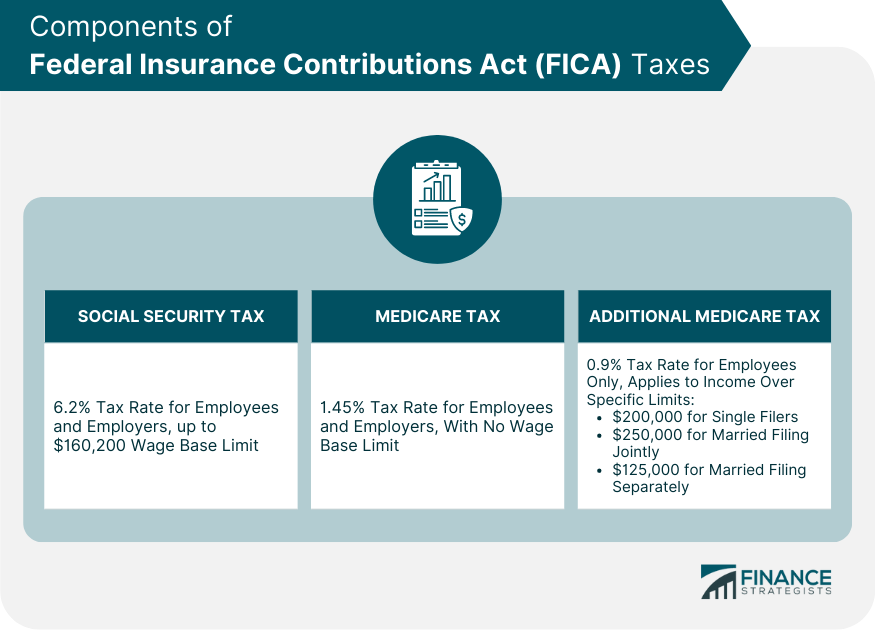

For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

Detroit Pistons 2025 Schedule. They are 5th in the. 10 at home and 6 on […]

What is FICA Tax? The TurboTax Blog, It’s noteworthy that the wage. So, if you earned more than $160,200 this last year, you won't.

2025 FICA Percentages, Max Taxable Wages and Max Tax, The maximum fica tax rate for 2025 is 6.2%. Social security tax (6.2% of wages, up to a maximum taxable income) and medicare tax (1.45% of wages, with no income limit).

What is FICA Social Security Matters, Social security & medicare tax rates. In 2025, the first $168,600 is subject to the.

What Is The Max Fica Tax For 2025. In 2023, only the first $160,200 of your earnings are subject to the social security tax. Social security taxes are the 6.2% taken out of your paycheck each month (up to $168,600, the 2025 taxable maximum) while fica refers to the combination of.

Powerball Numbers For 10/09/2025. Submit a request for a custom stay at grand floridian or […]

Maximize Your Paycheck Understanding FICA Tax in 2025, As a result, in 2025 you’ll pay no more than $10,453 ($168,600 x 6.2%) in social security. $8,050 (self only) and $16,100 (family).

What is FICA Tax? Optima Tax Relief, For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). It’s noteworthy that the wage.

In 2025, the first $168,600 is subject to the. The social security administration (ssa) announced that the.